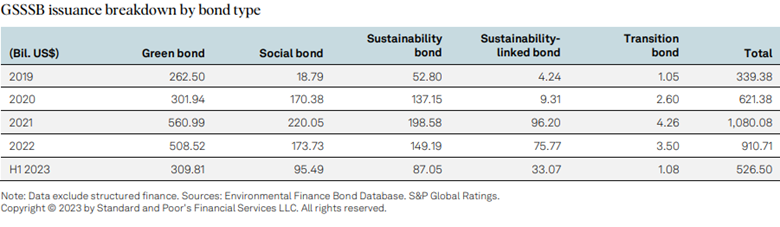

Although Global Bond Issuance has stagnated, financial market participants and leading credit rating firms predict a forecast of $900 Bn to $ 1 Trillion or 14% to 16% of total Green, Social, Sustainable, Sustainability-linked Bond (GSSSB) issuance in 2023.

To better understand this perspective, imagine a circular economy framework that generates job opportunities, tackles greenhouse gas emission reduction, reviews supply chain resilience by identifying extended lifecycles along with material recovery and its reusability having a potential upside of rekindling economic opportunities worth $4.5 Trillion in the near term.

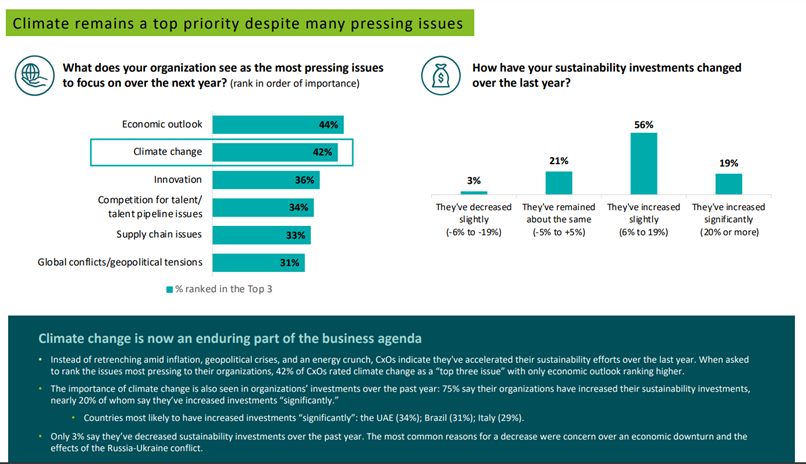

Regulators, Policy, and Law makers keen on upholding stakeholder sentiments have led to intense scrutiny around Environment, Social and Governance as the sustainable finance market is forecasted to cross over $50Trillion by F.Y.2025. Meanwhile, as asset classes matures, a variety of investor-centric products and approaches has enabled fixed income investors to benefit from expansion in sustainable financing instruments and intentionally move capital across social and/or environmental strategies to better achieve targeted gains.

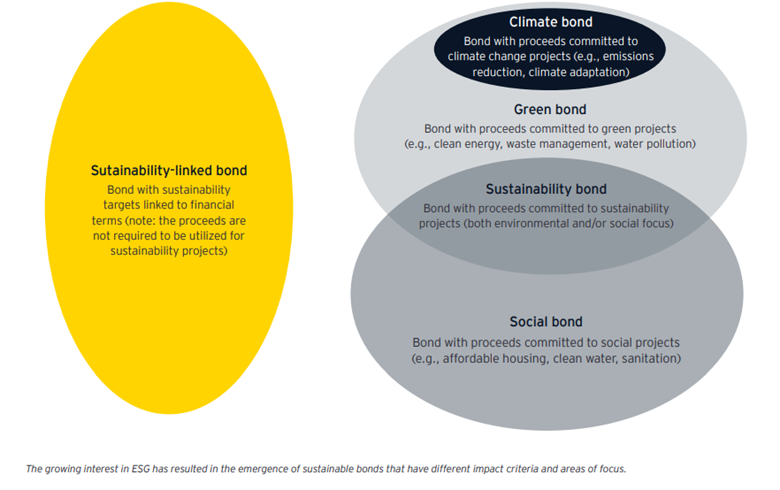

Bond issuance have consistently evolved over the past decade to keep pace with increasing focus on ESG by investors and businesses that has made way to a variety of sustainable bonds: – green bonds (subset climate bonds), social bonds, sustainability bonds and sustainability linked bonds, wherein the proceeds of most sustainable bonds are allocated towards sustainable projects, with an exception that sustainability-linked bonds (SLB’s).

Typically, SLB’s as forward-looking performance instruments are measured by financial and / structural characteristics attached to pre-determined Key Performance Indicators and assessed on financial terms linked to performance achievement of predefined sustainability targets (STP’s).

While issuance of sustainability linked bonds have seen a downward trend in 2023, largely due to assessment standards driving credibility of performance targets, green bonds continue to reign in the GSSSB (Green, Social, Sustainable, Sustainability-linked bond issuance) market. The international Capital Market Association (ICMA) refers to green bond as a financial instrument whose proceeds shall be earmarked exclusively for either financing/ refinancing projects that deliver measurable environmental and climate change benefits.

You may also be interested in reading: How Vegan is your Vegan supply chain?

Fast forward, and green bonds can be further classified as – 1. Standard Green Use of Proceeds Bond, 2. Green Revenue Bond, 3. Green Project Bond, 4. Green Securitized Bond and Covered Bond.

Understanding the new age Green Bonds

Standard Green Use of Proceeds Bond: standard recourse-to-the issuer debt obligation.

Green Revenue Bond: a non-recourse-to-the-issuer debt obligation in which the credit exposure in the bond is assigned to pledged cashflows of the revenue streams, fees, taxes etc., and whose use of proceeds is diverted to related or unrelated green projects.

Green Project Bond: a project bond for a single or multiple green project(s) for which an investor has direct exposure to the risk of project(s) with or without potential recourse to the issuer.

Green Securitized Bond and Covered Bond: a bond collateralized by one or more specific project(s) including, but not limited to Covered Bonds, Asset Backed Securities, Mortgage-Backed Securities, and any other structures that assures repayment based on cash flows stemming from assets.

As a confusing array of choices exists, leaders demand a rather robust, thematic and consistent alignment whilst adopting fixed income investment strategies as part of portfolio management and construction policies.

To conclude, while the financial sector has been assessing and addressing the topic of climate change, through a suite of green products and services, transaction volumes across sustainable and green bonds has seen a two fold growth in the past 2 years, as decarbonization frameworks and sustainability audit practices pushes corporates to classify funds under Article 8 or 9 of the EU Taxonomy to justify portfolio diversification that factors green labelled debt instruments vis-à-vis’ sustainable debts.

You may also be interested in reading: The Role of AI in Accounting: Advancements and Opportunities

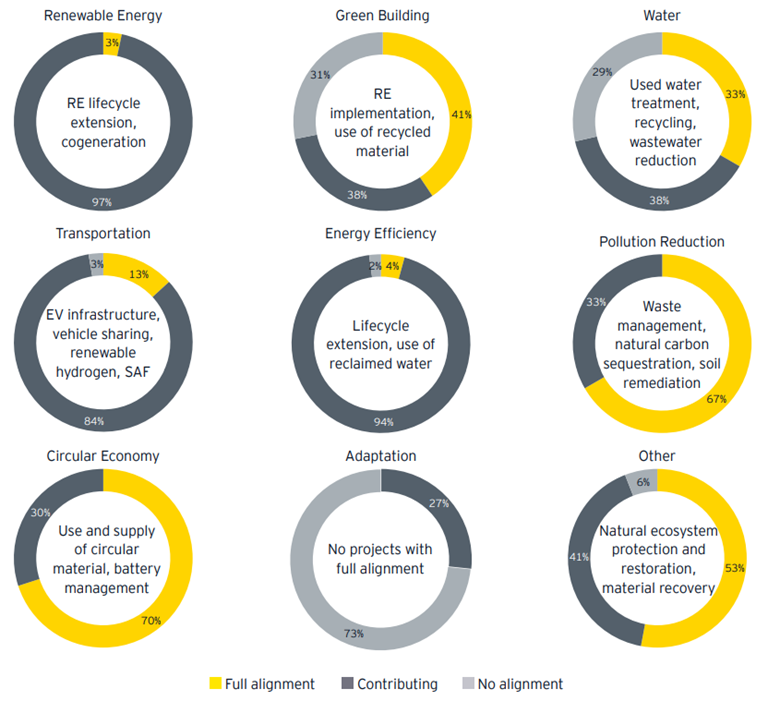

We are thriving amidst extremely interesting times where several sovereign financial institutions are exploring the dimensions of GSSSB issuance by integrating their national financing networks. F.Y. 2023 has witnessed Turkey, India, Israel, and Sharjah (UAE) adopting comprehensive and mature financial outlook having issued sustainability bonds, by monetizing and mobilizing domestic revenues in alignment with national sustainable development goals (primarily focusing on :- Renewable Energy. Green Buildings, Water and Transportation, Pollution Reduction etc.,) for attaining expenditure effectiveness and efficiency.

This has attracted a variety of multilateral development banks, insurance conglomerates and other financial institutions in pursuing, supporting, and establishing, despite potential headwinds (of short-term interest rate volatility, inflationary trends) to support net zero ambitions through a mix of Green, Social and Sustainability Bonds.